WHY MOBILE HOME OWNERSHIP MAY BE A GREAT OPTION FOR YOU

Tuesday, January 9th, 2018WHY MOBILE HOME OWNERSHIP MAY BE A GREAT OPTION FOR YOU

The Lore Group is often asked by purchasers if buying a mobile home is a good investment. Here are a few points we think purchasers should consider:

YOU WON’T BREAK THE BANK WHEN PURCHASING A MOBILE

Many people view home ownership as an unattainable dream. When purchasing a mobile home, you get to enjoy the perks of home ownership without the often higher financial cost of a traditional single family home. In this regard, mobile homes can make homeownership easier to achieve. And since mobile homes usually cost less per square foot than a stick built home, you can get more space and amenities for your money. Mobile homes can be purchased new or used, with used homes often offering even greater savings. The money saved affords a buyer much more freedom to experience all that life has to offer.

LOCATION, LOCATION, LOCATION

The negative stereotype of mobile home parks couldn’t be further from the truth. Most Fort McMurray mobile home communities are gorgeous! Check out areas such as Morgan Heights, Westborough Heights & Cartier Park in Timberlea. Newly rebuild areas in Beaconhill and Waterways offer both resale and brand new homes built with the most up to date energy efficiency packages. These beautiful neighbourhoods feature parks, playgrounds, waterparks and are close to schools and amenities.

QUALITY, SAFETY & ENERGY EFFICIENCY

Modern mobile homes are built in controlled environments by professional tradesmen. This means they can be consistently built to a high standard.

Many of the well-known mobile home builders are well-regarded throughout the industry for creating excellent homes, solidly built to exacting standards that address every aspect of the home; heating, plumbing, air conditioning, thermal and electrical systems, structural design, construction, fire safety & energy efficiency. Inspectors ensure that all standards are met, along every step of the way, from design, to construction to assembly. Recent technology has driven design forward and further improved the quality of Mobile Homes in a streamlined, proficient way that makes this type of housing affordable, safe, custom and environmentally sustainable.

ENJOY YOUR OWN PRIVATE YARD

For those with a love of gardening or family gatherings around the fire pit, mobile home ownership may be a perfect fit. Mobile homes in Fort McMurray have the added benefit of their own private and spacious yards. Safe and fun space for your children and pets to play, in many cases without restrictions often imposed by conventional condominium life, many lots feature generous privately owned parking and room to store all those toys.Fort McMurray offers both bareland condominium, and non condominium neighbourhoods. It’s important in any neighbourhood to become familiar with any rules and restrictions when determining if it’s the right place for you to set roots.

EMBRACE YOUR FREEDOM

There are so many different types and configurations of mobile homes, you can embrace this freedom and choose a home layout and décor that suits your lifestyle and personal taste. With mobile home lots now available to purchase at a reasonable cost, you can choose and customize your own brand new home! The most desired features of site built homes including bathrooms with whirlpools, walk-in closets, bay windows, fireplaces and fully-equipped kitchens with top of the line appliances. On the outside, you can choose your siding material and even build features like patios, decks, awnings, out buildings and fire pits, and in some cases yards are large enough for a garage. You can personalize…upgrade, paint, or completely remodel anytime you want. An added benefit to mobile home ownership is no overly close neighbor’s. While it is nice to get to know your neighbors, it’s also nice to have your own privacy. Unlike apartments, when you live in a mobile home you don’t share walls or a yard with your neighbors.

RESALE VALUE

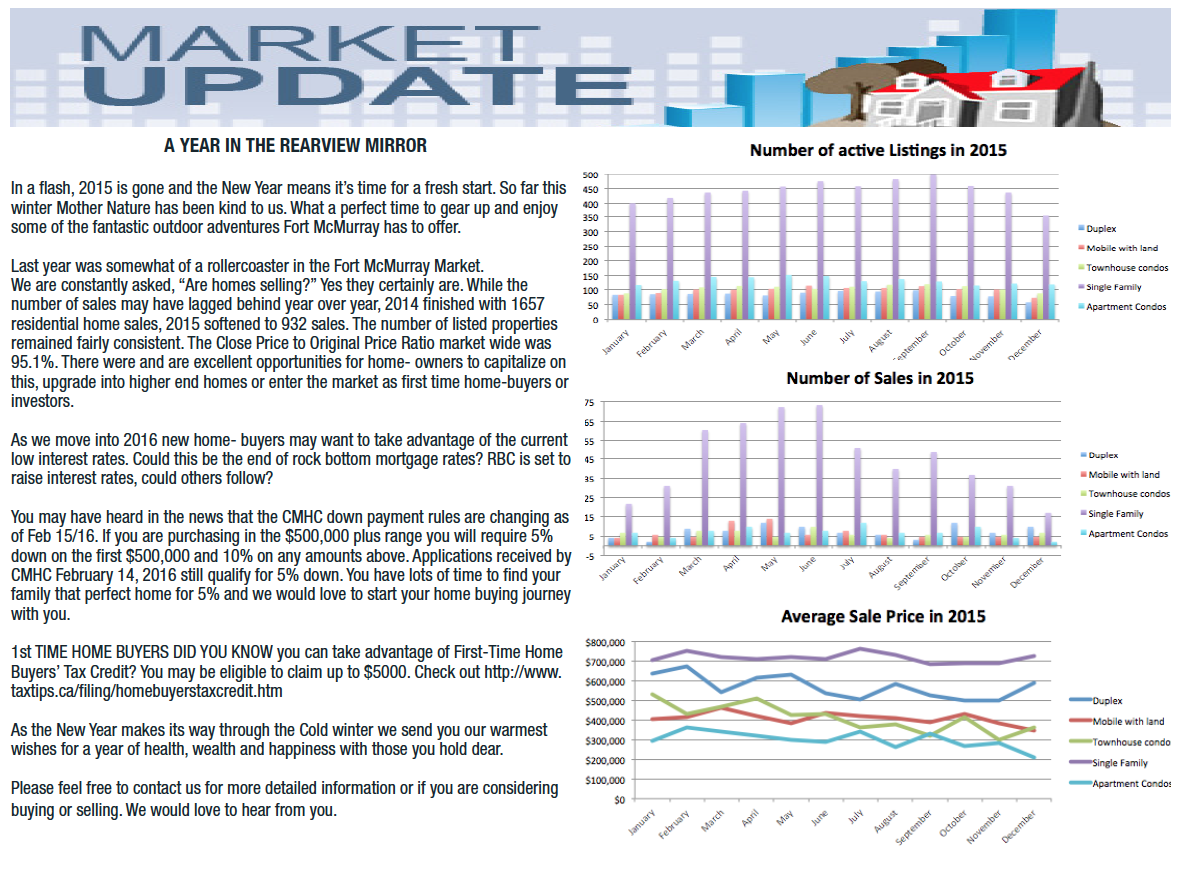

The Real Estate market in Fort McMurray has not been without its changes in the past few years. It may interest a purchaser to know that on a percentage basis mobile homes have retained the strongest values year over year in 2017.

Research, Research, Research

All things considered, when buying a new home is there any reason not to go the Mobile Home route? Whether you are a first-time home buyer, looking for a change from apartment life or making the transition from a traditional single family home the process can be daunting. With so many mobile home sizes, designs and locations to choose from, the options are seemingly endless. A Lore Group Realtor would be pleased to assist you with the research required to find you the perfect home in a location you will love.

THINKING OF SELLING YOUR MOBILE HOME??

If you are considering selling your Fort McMurray home and would like a FREE MARKET EVALUATION feel free to contact Micheal Cammock, Jamie Hewat, Tristan Parker or Susan Lore to find out how much your home is worth in today’s market and how The Lore Group, Coldwell Banker Fort McMurray, can help you.